Warren Buffett is very selective about the companies in which he invests. Therefore, investors should pay attention to holding on to an investment for decades, even as the company’s value increases enormously. Right now, one of Buffett’s best stocks is on sale. So far, Buffett hasn’t sold a single share.

This is Buffett’s perfect business

When deciding to invest in a specific company, Buffett takes many different factors into account. One of the most important is what economists call the economic moat. An economic moat is a type of competitive advantage that can last for years, if not decades.

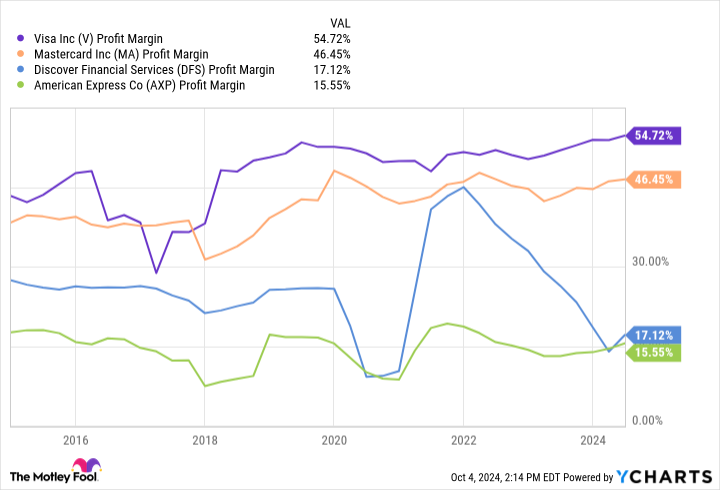

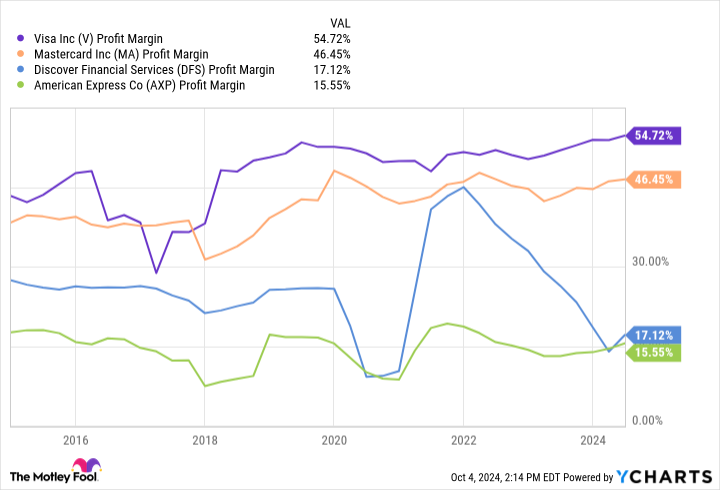

When it comes to strong economic moats, few companies can match the might Visa (NYSE:V). Just look at its market share data. By most metrics, Visa controls at least half of the U.S. credit card market. Only three companies… Discover financial services, MasterCardAND American Express – control the rest. Suffice it to say that it is a highly consolidated market, controlled by a handful of powerful competitors, of which Visa is by far the largest.

Merchants want to accept payment methods that consumers can use to pay. And consumers only want to have payment methods that sellers accept. It is this dynamic that has helped consolidate the U.S. payments industry – a dynamic that is becoming stronger over time. This is because Visa’s dominant market share provides two important advantages.

First, its network generates more data than its competitors combined, given that more than half of lending transactions take place on its network. Second, Visa’s business model is asset-light, resulting in higher levels of profitability as it scales. As Visa’s largest competitor, it can generate profits that its competitors cannot match. Over the past decade, Visa has dominated the competition in terms of profitability, posting profit margins of nearly 55% in the most recent quarter.

With a strong market position supported by natural industry consolidation and economies of scale, Visa has amassed an economic moat that most companies can only dream of.

Is it too late to buy Visa stock?

Buffett first bought Visa stock in 2011 at a price of about $40 per share. More than a decade later, the stock is trading above the $270 mark. Is it too late to get involved? Absolutely not. Shares are trading at just 29 times earnings – about that much S&P500 the index as a whole is recorded at . In short, you can buy Buffett’s long-term stocks with an incredible economic moat and profitability levels for zero premiums compared to the entire market.

Just know that it’s not all roses. Last month, the US Department of Justice announced an investigation into anti-competitive practices at the company. According to Politico, “The department blamed Visa for a wide-ranging scheme dating back to 2012, saying it artificially inflated the prices payment companies charged merchants and cut off competition from newer financial technology companies.”

This is not the first time Visa has been targeted by regulators. Several lawsuits have been filed over the past few decades, but none have managed to knock the company out of whack, although penalties have temporarily hurt financial performance. So far, Buffett doesn’t seem concerned, and his stance hasn’t changed since the news broke. This stock carries macroeconomic risk, but at 29 times earnings, it’s hard not to follow Buffett towards this proven blue-chip winner.

Don’t miss out on this second chance at a potentially lucrative opportunity

Have you ever felt like you missed an opportunity by buying the most successful stocks? Then you’ll want to hear it.

On rare occasions, our team of expert analysts issues a Double Down Wrestling. a recommendation for companies that they believe will soon achieve success. If you’re worried you’ve already missed your investment opportunity, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled in 2010, you would have $21,006!*

-

Apple: if you invested $1,000 when we doubled in 2008, you would have $42,905!*

-

Netflix: if you invested $1,000 when we doubled in 2004, you would have $388,128!*

We’re currently issuing “Double Down” alerts for three amazing companies, and another opportunity like this may not come around any time soon.

See 3 “double dip” stocks »

*Stock Advisor returns from October 7, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Discover Financial Services is an advertising partner of The Ascent, a Motley Fool company. Ryan Vanzo has no position in any of the companies mentioned. The Motley Fool covers and recommends Mastercard and Visa. The Motley Fool recommends Discover Financial Services and recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

Buffett’s Top Stocks to Invest Your $500 in Right Now was originally published by The Motley Fool

#Buffetts #stocks #invest